2024 Simple Ira Contribution Limits 2024 Over 50. That's up from the 2023 limit of $15,500. Written by lauren perez, cepf®.

The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000. Ira contribution limit increased for 2024.

The Ira Contribution Limits For 2024 Are $7,000 For Those Under Age 50, And $8,000 For Those Age 50 Or Older.

Salary reduction contribution up to $16,000 ($19,500 if age 50 or over) 5.

For 2024, You Can Contribute Up To $7,000 In Your Ira Or $8,000 If You’re 50 Or Older.

That’s up from the 2023 limit of $15,500.

For 2024, The Annual Contribution Limit For Simple Iras Is $16,000, Up From $15,500 In 2023.

Images References :

Source: alamedawroxy.pages.dev

Source: alamedawroxy.pages.dev

2024 Simple Ira Contribution Limits For Over 50 Beth Marisa, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. Simple ira and simple 401(k) maximum contribution.

Source: www.advantaira.com

Source: www.advantaira.com

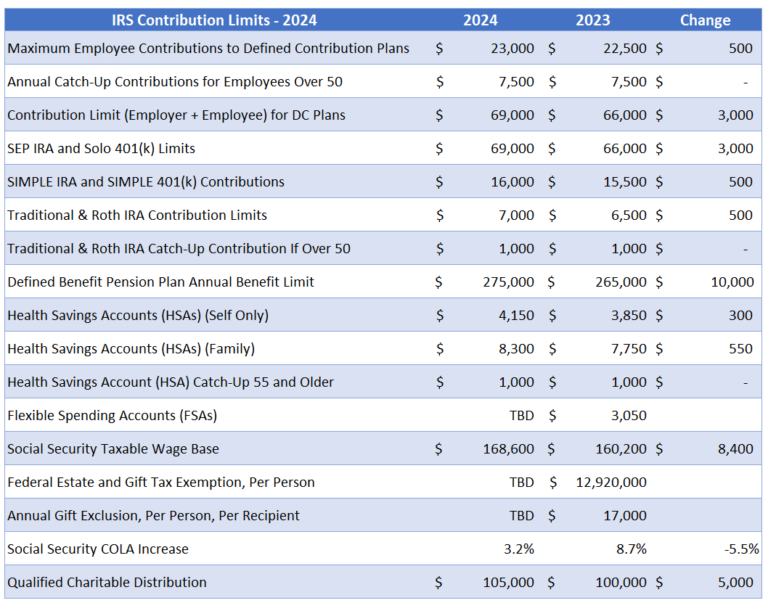

2024 Contribution Limits Announced by the IRS, Fact checked by patrick villanova, cepf®. For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

Source: beckyqmaible.pages.dev

Source: beckyqmaible.pages.dev

Simple Plan Contribution Limits 2024 Over 50 Rosie Zorina, That's up from the 2023 limit of $15,500. The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. The roth ira contribution limit for 2024 is $7,000 for those under 50 and up to $8,000 for those 50 or older.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. In 2023, simple iras allow for employee contributions up to $15,500 annually ($19,000 for those 50 or older);

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, The cap applies to contributions made across all iras you might have. Those 50 and older can contribute an extra $1,000 for a total of $8,000.

Source: katharinewlusa.pages.dev

Source: katharinewlusa.pages.dev

Roth Ira Limits 2024 Nissa Estella, Written by lauren perez, cepf®. Updated on december 22, 2023.

Source: ee2022d.blogspot.com

Source: ee2022d.blogspot.com

2022 Ira Contribution Limits Over 50 EE2022, The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000. In 2023, simple iras allow for employee contributions up to $15,500 annually ($19,000 for those 50 or older);

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, The cap applies to contributions made across all iras you might have. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, The total of all employee and employer contributions per employer will increase from $66,000 in 2023 to $69,000 in 2024 for those under 50. Get any financial question answered.

Fact Checked By Patrick Villanova, Cepf®.

Note that the 401 (a) limit is separate from the 403 (b) limit.

The Maximum Simple Ira Employee Contribution Limit Is $16,000 In 2024 (An Increase From $15,500 In 2023).

The roth ira contribution limit for 2024 is $7,000 for those under 50 and up to $8,000 for those 50 or older.